Assessing Managed Futures’ and Gold’s merits as portfolio diversifiers

Both managed futures and gold are often seen as investments which are potential diversifiers for equity investments. Gold is generally regarded as a safe-haven asset, which attracts flows in times of stress, while the main managed futures index has delivered positive performance for investors in each US equity bear market since 1987. For investors considering either gold or managed futures to provide diversification for an equity portfolio it is important to understand the fundamental differences in the return drivers.

Correlation to equities

To assess the potential diversifying value of a strategy, investors typically focus initially on the correlation profile of the strategy relative to the existing portfolio. Although gold and managed futures have gone through periods of positive correlation with equities, since January 1987 the correlation of gold with the S&P 500 index has been -0.06, while managed futures (as measured by the Barclay CTA index) has had a -0.02 correlation with the S&P 500 index. This highlights that, over the long-term, the return drivers of each are different to equites, and thus both could potentially provide diversification to a long equity portfolio.

Managed futures and gold, rolling 24-month correlation to S&P 500: January 1987 to September 2018

Source: Abbey Capital and Bloomberg. Please see page 6 for description of indices and definition of correlation.

Comparing historical performance

However, when considering managed futures and gold, investors need to have a sense not only of the correlation to equities, but also the return potential and what environment might be favourable or unfavourable for the investment.

Managed futures and gold, annualised returns: January 1987 to September 2018

Source: Abbey Capital and Bloomberg. Please see page 6 for description of indices and definition of Sharpe ratio.

Looking at the long-term performance of gold and managed futures reveals significant differences. Live data on managed futures performance is available since 1987 and from January 1987 to September 2018 the Barclay CTA Index, a leading index of managed futures returns, has outperformed substantially with an annualised return of 6.4% versus 3.6% for gold.

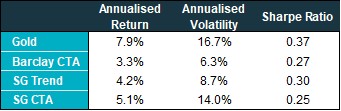

Managed futures and gold, annualised returns: January 2000 to September 2018

Source: Abbey Capital and Bloomberg. Please see page 6 for description of indices and definition of Sharpe ratio.

However, there have been periods of outperformance for gold. Indeed, since 2000, gold has outperformed managed futures due to its very strong performance between 2005 and 2010. The 1970s was also a very strong period for gold but unfortunately, data on managed futures performance does not extend back to the 1970s. However, commodities generally experienced strong trends in the period which may have provided opportunities for managed futures.

Preferred market environment

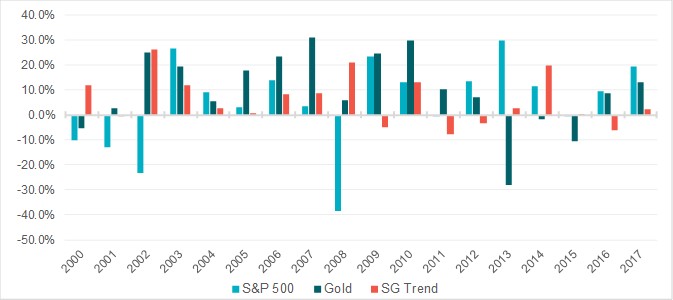

What is apparent looking at the longer-term returns and the pattern of performance is that gold and managed futures have very different drivers. The correlation between gold and managed futures since 1987 is 0.17, and the annual returns since 2000 in the chart on the next page highlight the different periods when their best returns were generated.

Gold posted stronger returns than managed futures between 2009-2012 when quantitative easing by the Federal Reserve contributed to concerns about fiat currencies and supported gold. These factors arguably contributed to the existence of fewer sustained trends in markets, which was more difficult for managed futures.

In the years since 2000 when the S&P 500 index suffered losses (2000, 2001, 2002 and 2008) both the SG Trend index and gold were positive in three of the four years, but the SG Trend index generally provided stronger returns.

In particular, during the Global Financial Crisis in 2008 the SG Trend index rose +20.9%, while gold rose +5.8%. In that year, gold sold off sharply between July and November, as the USD rallied when the financial crisis escalated, highlighting how the trend in the USD can at times usurp gold’s safe havens status as its primary driver.

S&P 500, gold and SG Trend Index annual returns: December 2000 to December 2017

Source: Abbey Capital and Bloomberg.

Spot gold and US Dollar index: March 1973 to September 2018

Source: Abbey Capital and Bloomberg.

Indeed, the chart above shows the spot price of gold going back to 1970, with the US Dollar index overlaid from March 1973 onwards. The two periods of very strong performance for gold (the 1970s and the 2000s) were periods of weakness for the USD. In contrast, periods of significant USD appreciation, such as in the early 1980s and the late 1990s, were particularly difficult for gold.

Overall since March 1973, gold has had a correlation of -0.37 to the USD. Of course, as gold is priced in US dollars this is not surprising; appreciation of the US dollar makes gold more expensive for non-dollar denominated investors and consumers.

More recently, 2014 was a good year for managed futures when the USD experienced a strong rally, while gold declined on the year. As trendfollowing is the most widely-used strategy in managed futures, in a period of sustained USD strength, managed futures managers can potentially profit from shorts in gold as well as from USD longs.

Interest rates, inflation and the rise of cryptocurrencies

The level and trend in interest rates also influences the returns in gold and managed futures. Rising US interest rates increase the opportunity cost for USD-denominated investors from holding gold, and increase the return for USD deposits (providing support for the USD). In contrast, higher US interest rates provide an additional source of return for USD-denominated managed futures programs, as futures are traded on margin and excess cash can generate interest.

Inflation is another factor to consider. As gold is a real asset, it should theoretically maintain its value in times of high inflation. However, if rising inflation is coupled with rising real interest rates, gold may be shunned for interest-paying assets. For example, between 1970 and 1980, historically high inflation produced negative real interest rates and gold prices surged. However, gold declined thereafter and traded within a range in the 1980s as monetary policy adjusted and real interest rates turned positive. In contrast, rising inflation may provide opportunities for managed futures managers, if inflation is associated with sustained price trends.

A further consideration for investors considering gold is whether cryptocurrencies now offer a credible alternative to gold. In the 2000s, concerns about currency wars and potential devaluations of fiat currencies were a key driver of the rise in gold. Cryptocurrencies offer that same potential diversification from fiat currencies, in the form of a digital asset rather than a hard asset. Although it remains to be seen whether cryptocurrencies will be an enduring phenomenon, the notable increase in interest in recent years, while gold returns have been muted, suggests there may have already been some diversification away from gold into cryptocurrencies.

Conclusion

Based on their historical correlation profile to equities, managed futures and gold are both potential diversifiers for equity portfolios. While they both share the characteristic of being investments which can perform well in times of stress, they each have very different drivers.

While gold has benefited from the perception of being a safe-haven asset, its performance is heavily influenced by the trend in the USD and real interest rates. Managed futures on the other hand tends to benefit from rising interest rates, and provides exposure to trends and price movements in a much broader array of markets.

There may be a role for both assets in a diversified portfolio; it is important for investors to understand the different return drivers when considering an allocation to each asset.

Indices

S&P 500 Index

The S&P 500 Index is an index of 500 US stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of US equities and is meant to reflect the risk/return characteristics of the large cap universe.

SG CTA Index

The SG CTA Index is a daily performance benchmark of major CTAs; it calculates the daily rate of return for a pool of CTAs selected from the larger managers that are open to new investment. Selection of the pool of qualified CTAs used in construction of the Index is conducted annually.

SG Trend Index

The SG Trend Index is designed to track the 10 largest trend following CTAs (by AUM) and be representative of the trend followers in the managed futures space. The index is equally weighted and rebalanced annually on the 1st of January.

Barclay CTA Index

The Barclay CTA Index is a leading industry benchmark of representative performance of commodity trading advisors. There are currently 541 programs included in the calculation of the Barclay CTA Index. The index is equally weighted and rebalanced at the beginning of each year.

US Dollar index

The US Dollar index, which was introduced in 1973, measures the value of the US Dollar relative to a basket of developed-market foreign currencies. The foreign currencies included in the index are as follows: Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona and the Swiss Franc.

Definitions

Correlation

Correlation is a statistical measure which quantifies the extent to which two assets, or securities, move in relation to each other. The correlation coefficient between two assets can vary from between -1 and +1, with a positive correlation indicating a tendency to rise and fall together, and a negative correlation indicating a tendency to move in opposite directions.

Sharpe ratio

The Sharpe ratio is a measure of risk-adjusted return. The measure subtracts the risk-free rate from the annualised performance of the asset or fund and divides by the realised annualised volatility. A higher (lower) Sharpe ratio is seen as indicative of stronger (weaker) risk-adjusted performance.

Important Information, Risk Factors & Disclosures

This document contains information provided by or about Abbey Capital Limited (“Abbey Capital”). It is for the purpose of providing general information and does not purport to be full or complete or to constitute advice.

Abbey Capital is a private company limited by shares incorporated in Ireland (registration number 327102). Abbey Capital is authorised and regulated by the Central Bank of Ireland as an Alternative Investment Fund Manager under Regulation 9 of the European Union (Alternative Investment Fund Managers) Regulations 2013 (“AIFMD”). Abbey Capital is registered as a Commodity Pool Operator and Commodity Trading Advisor with the U.S. Commodity Futures Trading Commission (“CFTC”) and is a member of the U.S. National Futures Association (“NFA”). Abbey Capital is also registered as an Investment Advisor with the Securities Exchange Commission (“SEC”) in the United States of America. Abbey Capital (US) LLC is a wholly owned subsidiary of Abbey Capital. None of the regulators listed herein endorse, indemnify or guarantee the member’s business practices, selling methods, the class or type of securities offered, or any specific security.

While Abbey Capital has taken reasonable care to ensure that the sources of information herein are reliable, Abbey Capital does not guarantee the accuracy or completeness of such data (and same may not be independently verified or audited) and accepts no liability for any inaccuracy or omission. Opinions, estimates, projections and information are current as on the date indicated on this document and are subject to change without notice. Abbey Capital undertakes no obligation to update such information as of a more recent date.

Pursuant to an exemption from the CFTC in connection with accounts of qualified eligible persons, this report is not required to be, and has not been, filed with the CFTC. The CFTC, the SEC, the Central Bank of Ireland or any other regulator have not passed upon the merits of participating in any trading programs or funds promoted by Abbey Capital, nor have they reviewed or passed on the adequacy or accuracy of this report.

Risk Factors: This brief statement cannot disclose all of the risks and other factors necessary to evaluate a participation in a fund managed by Abbey Capital. It does not take into account the investment objectives, financial position or particular needs of any particular investor. Trading in futures is not suitable for all investors given its speculative nature and the high level of risk involved. Prospective investors should take appropriate investment advice and inform themselves as to applicable legal requirements, exchange control regulations and taxes in the countries of their citizenship, residence or domicile. Investors must make their own investment decision, having reviewed the applicable fund offering material carefully and consider whether trading is appropriate for them in light of their experience, specific investment objectives and financial position, and using such independent advisors as they believe necessary. The attention of prospective investors in any fund managed by Abbey Capital is drawn to the potential risks set out in the offering material of that fund under the heading ‘Risk Factors’.

Where an investment is denominated in a currency other than the investor’s currency, changes in the rates of exchange may have an adverse effect on the value, price of, or income derived from the investment. Past performance is not a guide to future performance. Income from investments may fluctuate. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors and can result in a total loss of initial investment. Certain assumptions may have been made in this analysis, that have resulted in the returns detailed herein. No representation is made that any returns indicated herein will actually be achieved.

Potential investors are urged to consult with their own professional advisors with respect to legal, financial and taxation consequences of any specific investments they are considering in Abbey Capital products.

The information herein is not intended to and shall not in any way constitute an invitation to invest in any of the funds managed by Abbey Capital. Any offer, solicitation or subscription for interests in any of the funds managed by Abbey Capital shall only be made pursuant to the terms of the relevant offering material, including the subscription agreement and no reliance shall be placed on the information contained herein.

This document and all of the information contained in it is proprietary information of Abbey Capital and intended solely for the use of the individual or entity to whom it is addressed or those who have accessed it on the Abbey Capital website. Under no circumstances may it be reproduced or disseminated in whole or in part without the prior written permission of Abbey Capital.